On the 1st April 2019, over 1 million VAT registered businesses will be moved to HMRC’s new Making Tax Digital reporting platform. At first sight, this looks like a huge upheaval and cost to receive nine boxes of VAT data which HMRC already receives. However, if you look a little closer at the new reporting format being imposed by HMRC and also the tax regimes of European neighbours and beyond, it is clear that their end goal is unprecedented access to businesses accounting records.

At the core of MTD’s aims is ending manual intervention and human error which HMRC claim accounts for £600m in miscalculations. At the moment approximately 90% of VAT submissions are completed by a manual login to HMRC’s web portal and by keying in the numbers online with the remaining 10% using the current XML upload. The new MTD data exchange format is part of HMRC’s

computer servers that receive the VAT data and returns responses.

The changes coming into play on 1 April 2019 is just the ‘amuse-bouche’. If all goes to plan, the data demands are likely to widen to full ledger transaction reporting. Any transactions involving a VAT element will be stipulated: general ledger; sales; purchases; stock; and fixed assets. Ultimately, the requirement could be to deliver bank account-level transactions and to provide settlement details, too.

With this data from all parties in the transaction chain, HMRC, with hugely powerful analytical software, will be equipped to independently check everyone’s version of the tax transaction. Countries like Spain and Hungary now require live or near live reporting of sales invoices to process immediate checks and identify fast-moving frauds. In Italy and Brazil from this year, the tax authorities will be able to block suppliers invoices from going out the door if they do not like the look of the VAT treatment.

Within 5 years HMRC will have wanted to all but kill off the VAT gap.

For clients on the Apportionment or Margin schemes or perhaps Group VAT there could be some complications. Cloud solutions do not cope very well with either of these scenarios. There are a number of solutions to help you with the Making Tax Digital challenge including solutions to remove all of the time you spend on data entry and getting rid of the reams of paper, invoices, statements, and receipts that may engulf your business each month.

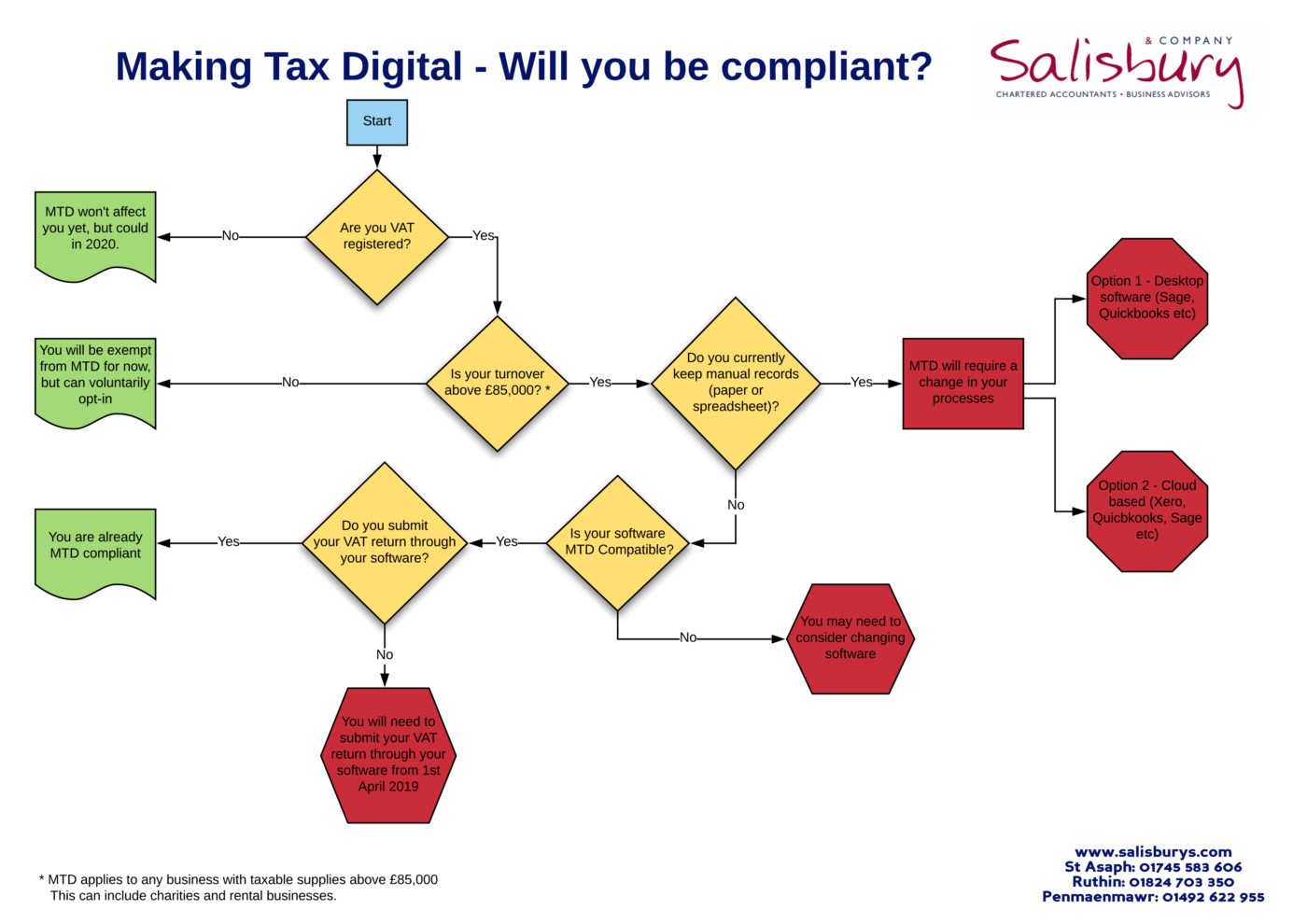

With just over two months until the start of MTD now is the time to take action. Follow our MTD flowchart to see how you will be affected, or for any queries get in touch.

By Jason Matischok, Director.

Jason joined the firm in 2003 as a Trainee Accountant. Having qualified as an Accounting Technician in 2006, Jason became one of the youngest to qualify as a Chartered Accountant in 2009. He was delighted to be invited to become a Director of the firm in 2016.